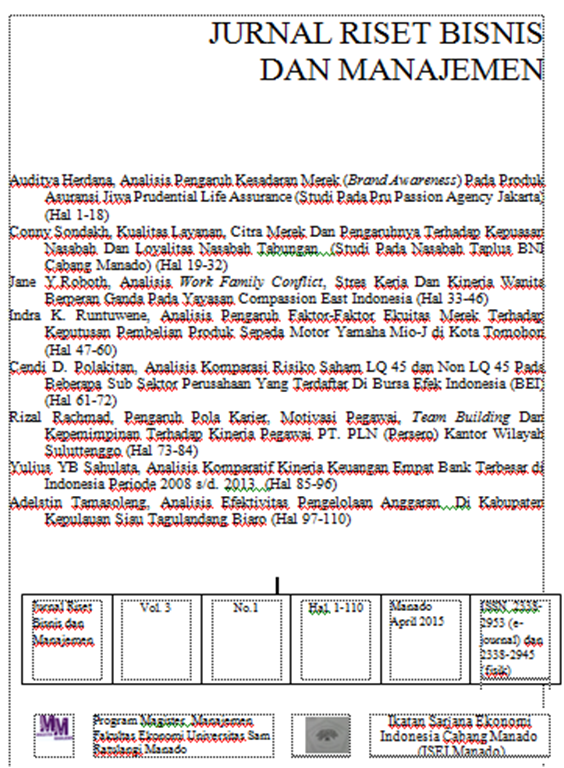

Analisis Komparasi Risiko Saham LQ 45 dan Non LQ 45 Pada Beberapa Sub Sektor Perusahaan Yang Terdaftar Di Bursa Efek Indonesia (BEI)

Abstract

This study aimed to examine the risk of Company Shares LQ 45 and Non LQ 45 listed in Indonesia Stock Exchange Year 2013.. The analysis was conducted on 39 companies LQ 45 and 39 Company Non LQ 45 listed in Indonesia Stock Exchange using the data period from February to July 2013, and Agustus 2013-January 2014. This study uses a variable risk (variance) as the dependent variable. Mechanical analysis using ANOVA (Analysis of Variance). The results show that there is no significant difference between Risk Stocks LQ 45 and Non LQ 45. This is attested by the significance value of 0.233 is greater than 0.05. And for the results obtained both by Sub Sector gained 3 Sub Sector Companies that have significant differences between Risk Stocks LQ 45 and Non LQ 45. This is attested by the significance value less than 0.05. Such third sub-sector, namely Sub Sector Food and Beverage with sig 0,001. Sub Sector Toll road, Airports, Harbor and Allied with sig 0,004. And Sub-Sector Energy with sig 0,045.Keywords: Index LQ 45, risk, variance