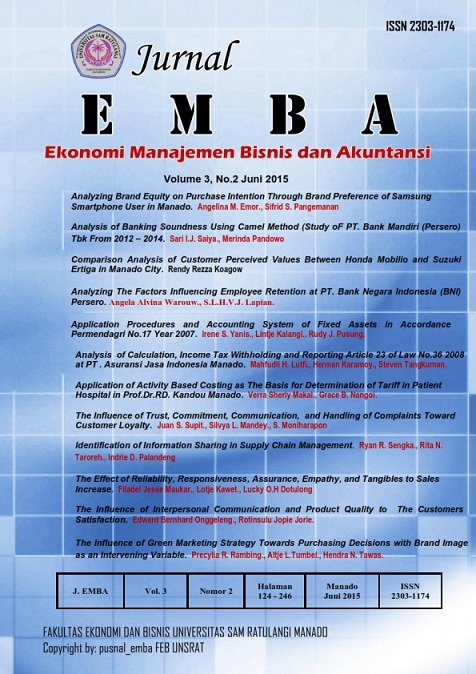

ANALYSIS OF CALCULATION, INCOME TAX WITHHOLDING AND REPORTING ARTICLE 23 OF LAW NO.36 2008 AT PT . ASURANSI JASA INDONESIA MANADO BRANCH

DOI:

https://doi.org/10.35794/emba.3.2.2015.8474Abstract

National Budget (APBN), a list where we can know the National  revenue target from taxation sector. National Budget 2013, shows that the tax revenue accounts is about 74% of the total National revenue overall, thus tax hold a very important role in financing national development. The purpose of this study is to determine the calculation, withholding and reporting of income tax according to article 23 in general insurance company of PT. Asuransi Jasa Indonesia. Method Descriptive Qualitative Method is used to analyse the data by collecting, describing, computing, and comparing a situation to be pulled a conclusion. Calculation, withholding and reporting income tax on income from construction services performed by PT. Asuransi Jasa Indonesia was based on Law No. 7 of 1983 as last amended by Law No. 36 Year 2008 on Income Tax and its implementing regulations either by government regulation, ministerial regulation and the General Director of Taxation. In the future if there is an error of recording and counting the charging of withholding list, Head of Finance Division at PT. Asuransi Jasa Indonesia should directly make an adjusting or correction of the Notice (SPT) Income tax (VAT) of Article 23 prior to depositing. Keywords: calculation,  income tax withholding, income tax reportingDownloads

Published

2015-06-30

Issue

Section

Articles